Critical illness is as the name itself implies, a serious health condition which can affect the lifestyle of an individual. The critical disease treatment can be costly. Critical illness can also be so severe that the person might have to discontinue going to work and hence, will not have any income. In olden days, the number of people with critical illness was very less. But, nowadays, thanks to the rising levels of pollution, increased levels of contaminants in everything you eat, right from vegetables, fruits to meat; the critical illness graph is also growing. The increased affinity to fast foods and soft drinks only adds to the woes.

The Financial Burden

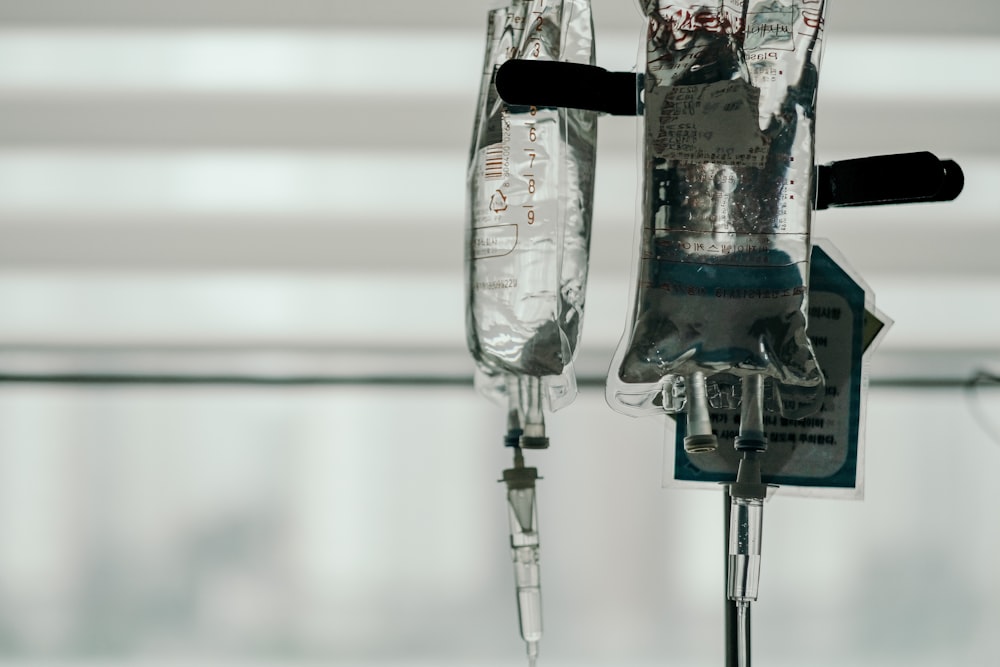

Critical illness is not only painful but also a financial burden. The rising hospital bills and cost of medicines can make it a harrowing experience for not only the ill person but also for all their near and dear ones. The usual health insurance plans will not cover such a substantial financial burden. In such cases, you will need a critical illness plan to meet the expenses of treatment. It not only helps you in paying off your hospital bills but also offers you a lump sum of money to meet your day to day expenses in the absence of your income from the job.

Who Will Need Critical Illness Policy?

The answer is simple. All those who suffer from critical illnesses like cancer, AIDS, paralysis and severe similar health conditions will need a vital illness health insurance to lead life forward and continue their treatments without being a financial burden on the family. Critical illness cover is one of the best options if:

- You are devoid of sufficient savings to help you sail through the rising needs of essential treatments of illness and procedures.

- You do not have an employee benefits coverage to offer assistance during critical illness and compensate for the days of absence from work.

Diseases Covered In A Critical Illness Cover

Here is a list of conditions that are usually covered in the critical illness cover:

- Cancer of a specific severity

- Permanent paralysis of the limbs

- Deafness

- Failure of kidneys leading to regular dialysis

- Open chest CABG

- Significant bone marrow or organ transplant

- A stroke which leads to permanent symptoms

- Coma of a particular severity

- Heart attack of a specified severity

- Loss of speech

- Liver disease end-stage

- Lung disease end-stage

- Repair of the heart valves or open-heart replacement

- Motor neuron disease along with permanent symptoms

- Muscular dystrophy

- Fulminant viral hepatitis

- Multiple sclerosis along with continuous symptoms

- Aplastic anaemia

- Large and serious burns

- Bacterial meningitis

This is just a short list of the most likely critical illness conditions. The list of critical illness covered under different insurance companies will be different. Always read the insurance quotes carefully and understand the coverages offered. Check whether the insurance covers your specific disease.

Exclusions From Critical Illness Cover

Here are some disease conditions that the critical illness insurance will not offer coverage:

- The critical illnesses which were diagnosed within the first ninety days from which the policy was incepted.

- The death that occurs within thirty days of diagnosing a disease or after surgery.

- The critical illnesses that are caused as a result of excessive drinking, smoking, drug or tobacco usage.

- Critical health issues or death that can occur as a result of complications in childbirth or caesarean.

- HIV/AIDS infections.

- Critical conditions that arise as a result of a war, navy operations, terrorism, military operations and civil wars.

- Cosmetic surgeries or dental care work.

- Infertility treatment after effects.

- Treatment for hormone replacements

- Procedures done to help in reproduction.

- Treatments that are done outside the nation.

Check List For Picking Your Critical Illness Plan

Here are some parameters you should check before choosing the critical illness coverage.

- The insured sum should be four to five times your annual income

- The waiting periods should be less.

- The premiums should be comparatively lower than the other options.

- The number of diseases covered by one policy should be extensive.

- The maximum renewability age should be high.

Filing The Claim

In case of a sudden need, you will have to submit the critical insurance claim to get the insured amount of money. For filing a claim, you will need the necessary documents first. The documents include a duly filled up claim form, photocopies of your identity card, a detailed discharge summary from the hospital, and a medical certificate from the doctor who treats you confirming that you are diagnosed of a critical illness. When you present these documents, the insurance claim team will conduct a check to test the authenticity of all the records. Then, you will receive a written form of communication informing you that your claim has been accepted or rejected as per the check conducted by them.

Critical illnesses are a part and parcel of life. Even though none of us desire to get such serious health conditions, fate can leave us in a state of shock! In such situations, the critical care illness policy can help you gather the pieces and face life with a new vigour. Usually, more than recovering from the illness, the thing that worries people is the burden of financial needs. When the financial obligations are met by the insurance, they are able to concentrate more on their recovery!